How do you do Value Analysis

Charts

Trading the foreign-exchange market around the world can seem overwhelming to inexperienced traders at first. Deciding when to exchange and when, with the aid of such resources, starts to get even easier. There is, though, one trading option-live forex charts-that trumps them all.

Live forex graphs help traders assess what’s happening in the market at the moment. They also offer useful hints and insights into what could happen next, but only for those who are well versed in how to read forex trading maps.

A chart is a graphical depiction of historical prices. The most popular forms of the chart are bar charts and charts with candlesticks. While these two forms of chart look quite different, in the detail they contain, they are quite similar.

Bar charts and candlesticks are broken into separate timeframes. For a specified period, each bar or candlestick reflects the high, low open, and close price.

Each bar/candle reflects one day of trading operation while looking at a standard chart.

When looking at a 15-minute table, each bar/candle reflects a 15-minute trading operation duration or session.

Candlesticks

While candlestick charts can also be used to evaluate other data forms, they were originally developed to promote financial market research. Back in the 17th century, the idea of candlesticks is believed to come from Japanese merchants.

A 1-hour map, for example, consists of several candlesticks, each representing a one-hour price shift. Each candlestick reveals the opening and closing prices (the candlestick body) and the high and low-price points (long lines above and below the core, often called wicks).

Candlesticks have different sizes of the closing and opening price and different colors based on the course of the market fluctuations. In general, ascending candlesticks are seen in green or black (filled). Candlesticks falling are usually red or hollow (white).

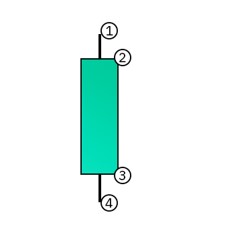

Ascending candlestick

- Upper wick: highest traded price in that period.

- Close: last traded price in that period.

- Open: first traded price in that period.

- Lower wick: lowest traded price in that period.

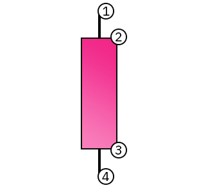

Descending candlestick

- Upper wick: highest traded price in that period.

- Open: first traded price in that period.

- Close: last traded price in that period.

- Lower wick: lowest traded price in that period.

The candlestick is perhaps the most common of the many types of charts among traders and chartists. Perhaps since, as opposed to the traditional line and bar maps, candlestick charts are physically simpler to understand.

Candlestick maps have been used and researched widely since their development and are now a vital feature of capital markets. So, one of the most important and crucial moves of any aspiring trader is learning how to read candlesticks and how to recognize their patterns.

Technical Analysis

The monitoring and visualization of movements and price movements by different technological metrics or tests require technical analysis. This price-time relationship can not only help traders see and analyze more details but can also help recognize places of indecision or sentiment reversal. As a result, technical research is used to better evaluate the inputs and outputs on the probability of establishing a technique or approach.

Technical forecasting is based on the theory that markets are unpredictable (nobody knows for sure what will happen next). Still, price behavior is not necessarily spontaneous at the same time. In other words, mathematical Chaos Theory proves that there are recognizable phenomena that appear to replicate within a state of chaos.

This sort of disorderly action takes the form of weather forecasting in nature. For example, most traders would agree that when it comes to forecasting exact price shifts, there are no certainties. As a result, good trading isn’t about being correct or wrong: when the chances are in your favor, it’s just about assessing probability and taking trades. Forecasting market direction and when / where to reach a position is part of deciding odds but deciding the risk-to-reward ratio is equally critical.

Know, there is no perfect blend of technical metrics that can activate a strategic trading technique of any kind. Strong risk management, concentration, and the capacity to monitor your feelings are the keys to good trading. Anyone can guess correctly and win every once in a while, but it’s nearly difficult to stay profitable over time without risk management.

Social Community

Social media continues to have profound effects on sectors. Cryptocurrency and blockchain technology is one such sector. A lot of growth and interest in cryptocurrencies can be traced to social media.

From the modest origins of the social forums in digital currencies to the established social media networks, social technology and cryptocurrency still have a remarkably close partnership.

This social network, bitcoin, and blockchain interaction continues to grow in new and exciting ways. When cryptocurrency and blockchain innovations flourish, the effect of one on the other has now become reciprocal. Also, social networks focused on blockchains are sprouting out.

As long as posts, data, and updates on cryptocurrency continue to consume news feeds on social media; the future looks promising for crypto-social relationships. Social media and other media sources may cause market volatility in cryptocurrencies, for better or for worse.

Trending reports of a major hack of digital currency exchanges will trigger a substantial decrease in the value of a digital currency. For example, when the Hong Kong-based Bitfinex exchange was hacked, the valuation of Bitcoin fell 20 percent. This creates a big pitfall in the crypto-social connection.

Cryptocurrency Social Effect

For the development of digital currencies and blockchain technologies, social media and forums are still important. How will that be? Oh, as the rise of crypto-currency progresses, people and enterprises are more involved in investing in it.

You’ll most likely need to turn to social media and forums to get the most updated crypto news. Bitcoin, for example, will trace much of its success to the Reddit discussion network.

In reality, one of the biggest outlets for social influencers is Reddit. They can both be seen offering up insight on Reddit, from crypto-enthusiasts to crypto-analysts.

- How to Make Money Trading Forex with No Previous Experience - September 23, 2020

- Free Trading Training – Master the Online Trading World - September 22, 2020

- How Much Money Do Forex Traders Make Per Day? - September 22, 2020